The ACE Community Fund

ACE Cash Express gives back through our community involvement, sponsorships, and donations.

ACE Community Commitment

In 2023, the ACE Community Fund donated over $1 million to 17 charities nationwide.

Since 2004, we have donated more than $18 million to communities in need thanks to the generous support of ACE employees and customers. Our corporate giving program, ACE Community Fund, works with transformative charities across the country to give back to the community.

Our stores participate in fundraising efforts as well, through initiatives like our annual Give A Little Campaign, during which our retail associates choose a charity to support and fundraise for during the month of May.

ACE's Proud Partnership with National Breast Cancer Foundation

Our Pink Month Celebration Each October

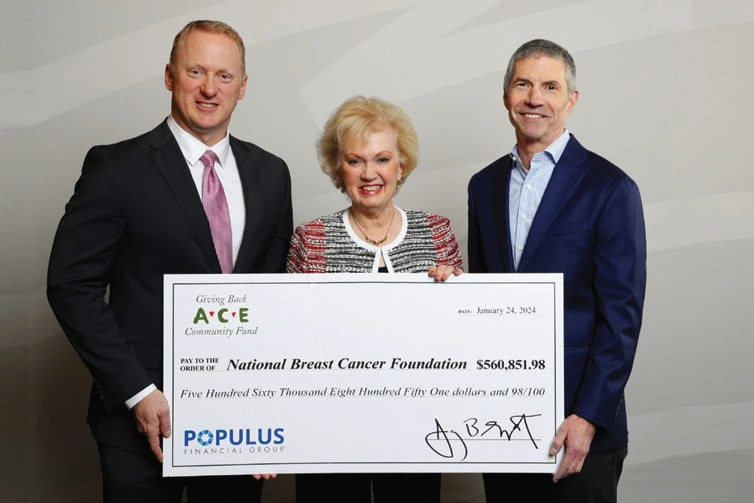

In 2023, ACE donated $560,851 to the National Breast Cancer Foundation (NBCF) in partnership with Ouro Global, Inc. Each October, ACE hosts Pink Month in observance of National Breast Cancer Awareness Month to support NBCF’s mission to save lives and educate women about the importance of mammograms.

The generous customer and employee donations during Pink Month and purchases made using the Pink Flare Account® and Pink ACE Elite® Visa® Prepaid Debit Card1, and by certain Porte® members2 have allowed ACE and Ouro Global, Inc. to support NBCF for the past 17 years. Together, we have donated more than $9 million, providing 432,000+ free breast screening and diagnostic services and patient navigation services to women in need.

“Populus’ long-term partnership has made a significant impact to our mission of Helping Women Now®. In addition to the funds and awareness that they have raised over the years, their team has made an on-going commitment to volunteer their time and resources at our headquarters to pack HOPE Kits and write encouragement cards to women undergoing breast cancer treatment across the country” -- Janelle Hail, NBCF Founder & CEO

ACE Customers “Chip In For Charity”

Our “Chip In For Charity” program raised $283,405 in 2023. In this program, customers select among five national charities to support and then simply use their co-branded charity Flare Account® debit card whenever they shop. ACE donates an amount equal to a portion of every purchase made to the associated charity up to preset limits.3 Our ACE “Chip In For Charity” partners in 2023 were AdoptAClassroom.org, Homes For Our Troops, National Breast Cancer Foundation, Save the Children, and The Humane Society of the United States.

“The Humane Society of the United States is thankful for the continued support from the Chip in for Charity program, which is helping us continue our mission to fight for all animals.” -- Kristie Tanner, Director of Business Partnerships for the Humane Society of the United States

Who We've Supported

- AdoptAClassroom.org

- Alex's Lemonade Stand Foundation

- American Red Cross

- Autism Speaks

- Back On My Feet

- Christmas Providers

- Feed My Starving Children

- Feeding America's Local Food Banks

- Greater Cleveland Food Bank

- Homes For Our Troops

- Irving Cares

- Junior Achievement

- MenzFit

- National Breast Cancer Foundation

- Save the Children

- The Humane Society of the U.S.

- The Rise Center at UT Dallas

What The Charities Love About Us

Homes For Our Troops

"The generosity of partners like Populus Financial Group enable us to build even more specially adapted custom homes for severely injured veterans like the one that will be donated to Marine Corporal Raymond Hennagir. Their commitment to our mission of Building Homes and Rebuilding Lives is exemplary and we are deeply grateful for their support."

-- Tom Landwermeyer, HFOT President/CEO Brigadier General, USA (Ret)

Alex's Lemonade Stand Foundation

"We are grateful for the dedication of the customers and employees at ACE who continue to show their commitment to the cause each year. Their support allows us to continue our mission to fund critical research as well as provide support to families looking for a cure."

-- Liz Scott, Co-Executive Director

Careers

Interested in joining ACE Cash Express? We are always looking for dedicated, talented people to become a part of our team.