Flare Account®

An Online Account Designed for You

The Flare Account's mobile app and Online Account Center give you ultimate control of your money on the go with ease. Experience online banking streamlined with real-time updates and text message alerts along with other helpful financial features.

Banking services provided by Pathward®, National Association, Member FDIC.

Get paid up to 2 days faster2 with Direct Deposit

No-Fee3 cash withdrawals up to $400 per day from your Account at participating ACE locations with qualifying Direct Deposit

Deposit Account opening subject to registration and ID verification.1

ACE Elite® Visa® Prepaid Debit Card

Make Everyday Spending More Convenient

The all-purpose ACE Elite Card is a reloadable card you can use in-person and online to pay bills or make purchases. Plus, you get the benefits of having a Visa prepaid card without having to worry about credit checks, expiring funds, or overdraft fees.

No-fee6 cash withdrawals up to $100 per day at participating ACE locations with qualifying Direct Deposit

Get paid up to 2 days faster7 with Direct Deposit

Pay a predictable monthly service fee when you qualify for the Reduced Monthly Plan8

Get an ACE Elite Card online with the purchase fee waived and get on a rewarding new financial path.

Subject to card activation and ID verification.1

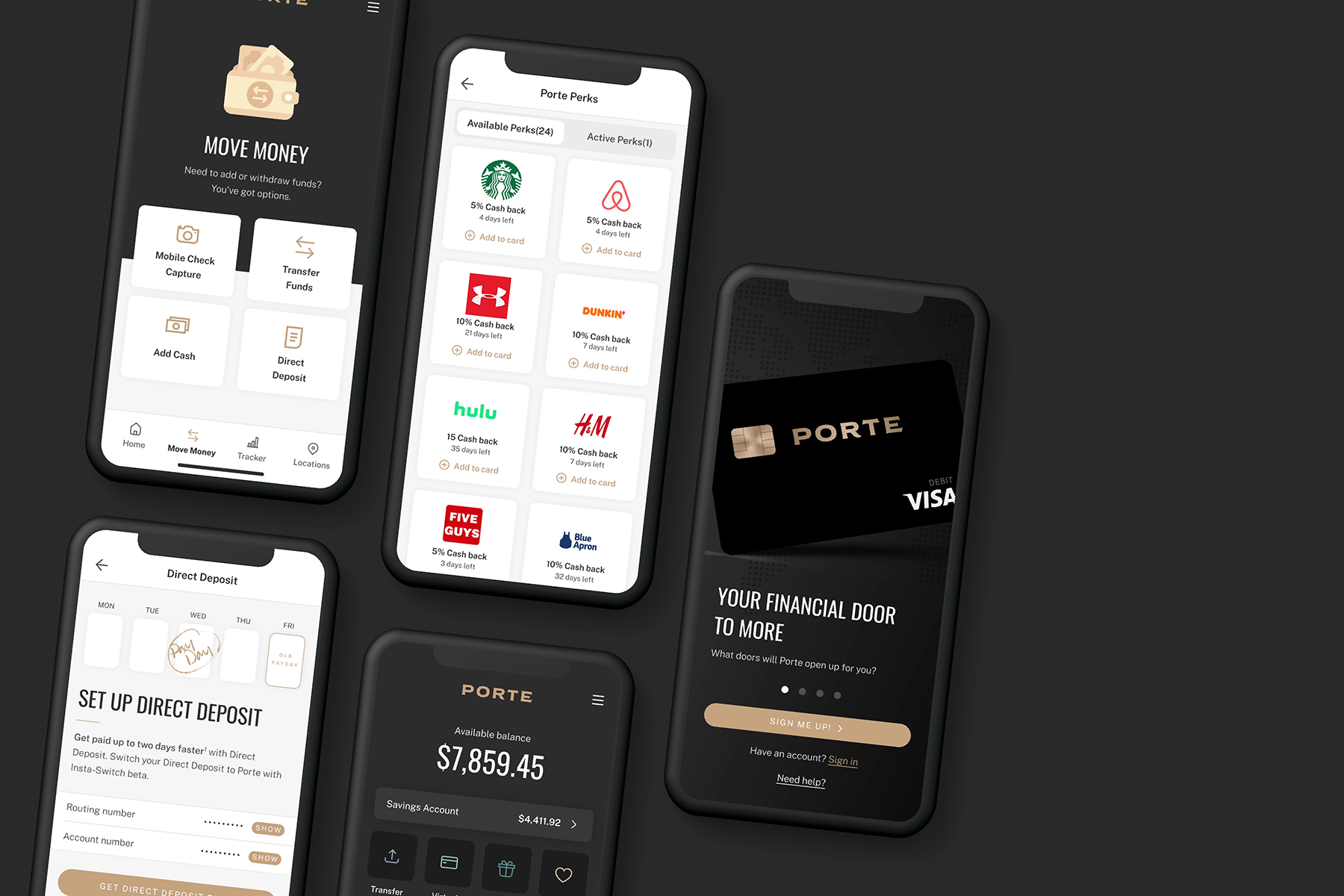

Porte® Mobile Banking

On-the-Go Mobile Banking with No Monthly Fee When You Have Qualifying Direct Deposit10

With Porte, you have access to amazing features – all from your mobile device! Easily manage your money with mobile banking and access cash withdrawals at approximately 40,000 fee-free MoneyPass ATMs.11 Keep more money in your pocket with $0 monthly fee when you have qualifying Direct Deposit.10

Banking services provided by Pathward, Member FDIC.

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, Member FDIC.

Flare Account FAQs

Start an application online1 or visit an ACE Cash Express store to get started!

You can use your Flare Account debit card for all your regular everyday purchases. Pay bills, buy groceries, shop online, pay for gas … the options are endless! You can use your Flare Account debit card wherever Visa® debit cards are accepted.

The standard monthly service fee for the Flare Account is $9.95. If you have qualifying Direct Deposits totaling at least $500.00 in one calendar month, the monthly fee is lowered to $5.00.12

The Flare Account is a deposit account with extra benefits you’ll really love, including no-fee cash withdrawals up to $400 a day3 with qualifying Direct Deposit at ACE Cash Express locations.

ACE Elite Card FAQs

You can order a prepaid card online.1 There’s no credit check and no cost to order online. Alternatively, visit an ACE Cash Express store location to apply!

There’s no cost to order an ACE Elite Card online.1 Once you activate the Card and verify your identity, you may be able to choose from our selection of fee plans. To view the fee plans, card load fees, and other costs associated with using the Card, see the Rates page on the ACE Elite Card website.

You can enroll in Direct Deposit, deposit your tax refund, or visit an ACE Cash Express store to add cash.13

Porte Account FAQs

Porte is a mobile banking app with the service you love. Porte has been designed around the idea that banking has a purpose and is focused on transparency in banking. We work with Pathward to bring you a premium mobile banking experience that provides the access you need. The name Porte comes from the French word for “Door”. Porte is an open doorway to banking that gives back. At Porte, we’re listening to our customers and we’re ready to learn and evolve with them to secure their future. We’re bringing modern mobile banking with the in-person service you need.

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, Member FDIC.

With Porte, you can take advantage of no monthly fee when you meet Direct Deposit requirements,10 $0 fee to add cash at ACE locations with qualifying Direct Deposit,14 $0 ATM fees at approximately 40,000 MoneyPass® ATMs,11 and $0 fees for cash withdrawals of $500 or less per day at ACE stores with qualifying Direct Deposit.15

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, Member FDIC.

With Porte, a qualifying Direct Deposit of $1,000.00 a month can waive your monthly account fee.10 Plus, you’ll enjoy a robust mobile app experience and so much more!