Unexpected expenses can strike at any moment. Car accidents, hospital visits, and other events can turn your financial world upside down. If you’re considering taking out a short-term loan with ACE, you want to be informed about your options.

At ACE, anyone is free to apply; however, the amount you can borrow depends on a number of factors, including your state, the type of loan you’re interested in, and your income.

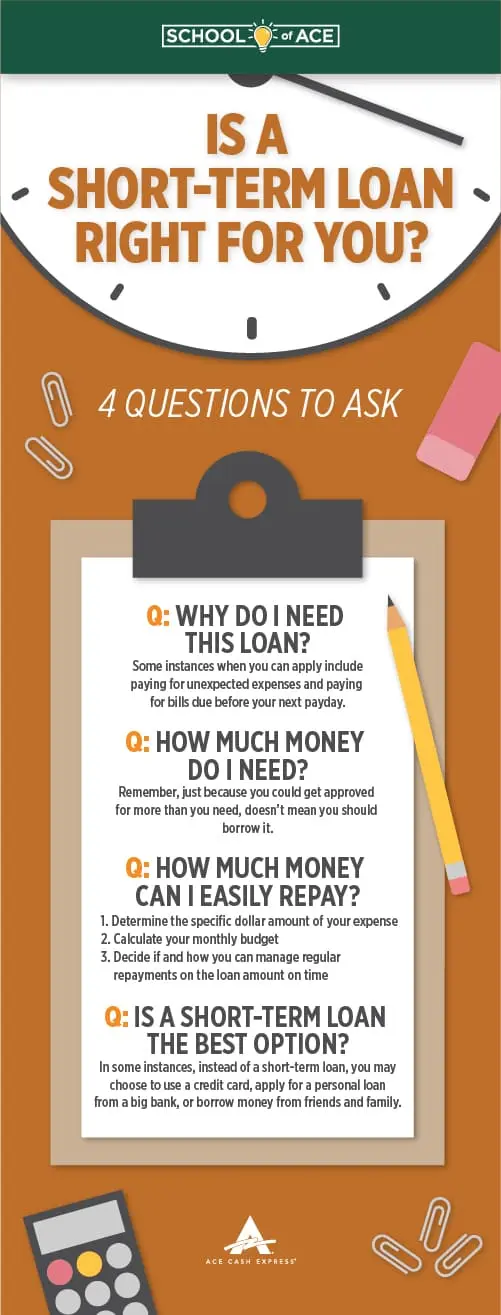

Whether you’re considering a short-term loan from ACE or another lender, you should always ask yourself a few questions as you decide how much money to apply for.

How to Decide if a Quick Loan is Right for You: 4 Questions to Ask

Why do I need this loan?

There are many reasons you may decide to apply for a short term loan, installment loan, or other types of loans. However, a short-term loan may not be your best option in all circumstances. Some instances when you may decide to apply for an online loan include:

- Paying for unexpected expenses

- Paying bills due before your next payday

As a smart spender, you know the importance of maintaining good credit history. With that in mind, remember short-term loans are not ideal for:

- Paying off other loans

- Buying “nice to have” items that may be out of your current budget

- Having extra cash in your pocket

How much money do I need?

It can be tempting to ask for the maximum loan amount available to you and hope to be approved. After all, if you get more than you initially expected, you can do even more with the money, right? Wrong. “Overborrowing” is a lending phenomenon in which people borrow more money than what they need. Overborrowing can result in feeling that you’re drowning in debt with no way out.

If you’re borrowing money for upcoming bills or car repairs, you likely have a specific dollar amount due.

How much money can I easily repay?

When you’re in need of a short-term loan, it’s easy to get caught up in the present need and not think into the future. Being approved for the money you need to stay afloat is a top priority, but you could put your future self in a dangerous spot if you don’t think ahead.

Part of avoiding overborrowing includes keeping your current budget in mind before you apply for a short-term loan. Make sure you will be able to repay the full balance of your loan within the term period.

You can use a loan calculator online or do the math yourself:

- Determine the specific dollar amount of your expense

- Calculate your monthly budget

- Decide if and how you can manage regular repayments on the loan amount

This will help you determine the amount of money you should reasonably apply for and be able to repay.

Is a short-term loan the best option?

There are many methods to borrow money when you need it. You can use a credit card to pay for unexpected expenses. You can borrow money from friends and family. You can apply for a personal loan from a big bank. You can also choose to apply for a short-term loan.

Determining which borrow method is best depends on a few factors:

- How much money you need

- Your ideal repayment timeline

- What you’ll use the money for

- Your credit history and expectations for approval

- Your banking history and relationship with traditional banks

Weigh your options before applying for a short-term loan. You may consider the interest on the loan, the repayment schedule you expect, and your actual level of need. Then, you can make a decision you feel confident about.

Is an online short-term loan the best option for you? You can learn more about loans at ACE and apply today for the money you need.