Does it seem like some people are naturally good with their money? Their savings account blossoms, they travel every year, and their credit score shines? It’s not magic or luck that gets these savvy people far. Instead, discipline and sound money habits make financial fitness possible.

People aren’t born with the innate knowledge of how to save money. Financial fitness is taught—and it’s a skill set anyone can learn!

What is Financial Fitness?

The CFA Institute (Chartered Financial Analyst Institute) defines financial fitness as:

“… feeling good and confident about your financial situation. It means being able to manage your money in order to meet your current and long-term needs.”

When you feel in control of your spending and saving, you feel more confident about the future. Saving for your child’s college tuition feels doable. If your vehicle breaks down and you need to consider buying a new car , you have an emergency fund prepared.

With a financially fit mindset, you’ll know how to use credit cards responsibly. You’ll also know when it’s an appropriate time to seek out a loan to meet your financial needs.

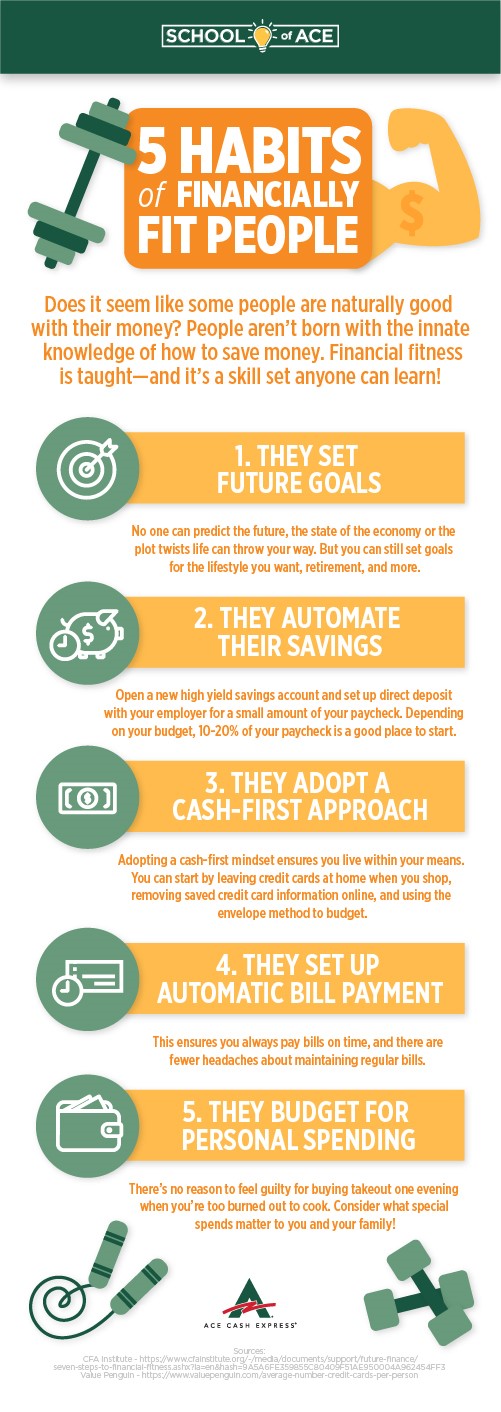

So, what makes someone “financially fit?” We’ve uncovered 5 money management habits you can incorporate into your lifestyle.

How Financially Fit People Save Money with 5 Practical Money Management Habits

- They Set Future Goals

Life moves fast. Sometimes it feels like one moment you’re saying, “Happy Friday!” to all your coworkers, and the next thing you know, it’s Monday again. When you’re always on the move, it’s challenging to find time to take a step back and see the big picture.

However, if you want to improve your financial fitness, cultivate a habit of setting long-term goals. Financially fit people know the destination they desire for their life (even if they may not be 100% sure how they’ll get there.)

No one can predict the future, the state of the economy or the plot twists life can throw your way. But you can still set goals including:

- When you want to retire

- How soon you want to buy a house and pay off your mortgage

- How much money you want to save for your children’s education

- The lifestyle you want to have as you age

2. They Automate Their Savings Account Transfers

Many people find it challenging to put money into their savings accounts. When money is already tight, those dollars you want to put into savings can easily be used for other purchases. That’s why we recommend automatic transfers to your bank savings account as a financial fitness habit.

Open a new high yield savings account and set up direct deposit with your employer for a small amount of your paycheck. Depending on your budget, 10-20% of your paycheck is a good place to start.

You’ll likely find that it’s much easier to stick to your savings goals when money automatically deposits. In this instance, “out of sight, out of mind” can be a helpful mantra.

3. They Adopt a Cash-First Approach

According to ValuePenguin, “the average American carries 2.35 credit cards and a total outstanding balance of $5,551.” Purchasing items on credit is the norm for many Americans, but financially fit people make smart decisions about how they use their credit. They choose to make a habit of using a cash-first approach for spending.

Adopting a cash-first mindset ensures you live within your means. Some ways to implement this habit into your financial life include:

- Leaving credit cards at home when you head out to run errands or shop

- Removing credit cards from your saved card information online

- Try the envelope method for cash budgeting each time you get paid

4. They Set Up Automatic Bill Payment

One of the most important factors in determining your credit score is your number of on-time bill payments. Keeping track of upcoming bills on a spreadsheet or your phone can be a challenge. That’s why financially fit people choose to set up automatic bill payment withdrawals. This ensures they always pay bills on time, and there are fewer headaches about maintaining regular bills.

You can set up automatic ACH (Automatic Clearing House) payments through your biller or from your bank provider. Remember that just because you set up ACH payments, doesn’t mean you can forget about your bills.

Each month check your due dates and how they correspond to your pay cycle. If you need to move payments around or save a little more money in one check to cover the transfer, be sure to include that. That way, you won’t be surprised by unexpected automatic withdrawals.

5. They Budget for Personal Spending

The standard advice you may hear involves cutting out personal spending from your budget if you want to save money. At ACE, we believe that part of what makes life special is indulging in occasional purchases that add meaning to your life. However, with finances, just as with your physical health, overindulging can cause serious damage.

People who are financially fit make room for special purchases within their budget, rather than in spite of it. There’s no reason to feel guilty for buying takeout one evening when you’re too burned out to cook. By planning, you can make that purchase and still stay on track.

As you put together your budget for personal spending, consider what matters to you and your family:

- Weekly family dinners at your favorite restaurant

- Morning coffee from the local coffee shop

- Seeing the latest movie at the theater

- Adding new pieces to your wardrobe monthly

- Staying current on trending shows from your favorite streaming service

Make it a habit to put money to the side to cover these “special” expenses and feel more confident in your purchase decisions.

The health of your finances is in your hands. Make these 5 financial fitness tips a habit and improve your budgeting skills!

Want even more money management tips? Head to Facebook to join the conversation!