Choosing a new bank account? Considering switching to a new bank?

A 2017 survey found that most Americans stay with the same bank for an average of 16 years. It takes a lot to finally make the choice to move banks, simply because there’s so much involved. Updating your direct deposit, changing all your bill payment information, changing your preferred payment method on Amazon … whew!

That’s why it’s so important to make sure that you’re getting the most out of your bank account. The more you know about features that today’s banks offer, the smarter decision you can make.

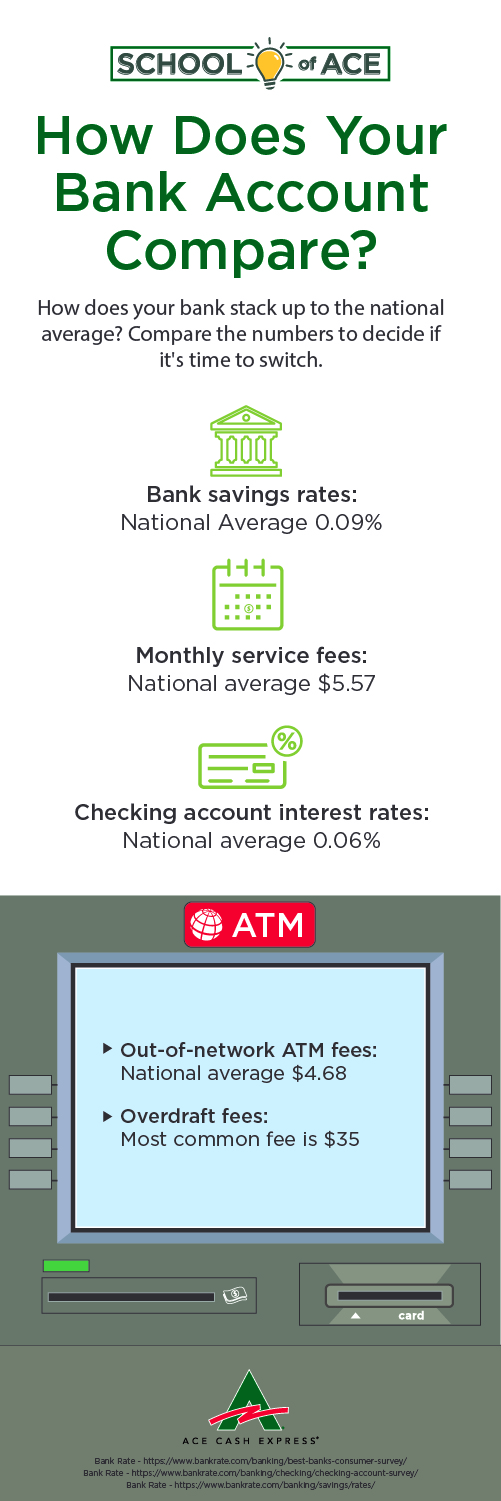

Compare Bank Account Fees

When it comes to your money, you want to keep as much of it as possible (of course!). When looking for ways to get more from your bank account, check out fees and other areas where your earnings could be slipping away.

Bank savings rates:

According to FDIC’s weekly national rates, the national average for Savings Account APY for Deposits under $100,000 as of May 24, 2019 is 0.09%. The average you’ll actually earn may be based on factors such as how much you have in your account and how much you deposit into your associated checking account.

If you’re interested in exploring a high-yield savings account, you may consider the ACE Flare™ Account by MetaBank®. When you establish direct deposit, you qualify to open an optional Savings Account, you could earn up to 6.00% Annual Percentage Yield (APY) on deposits up to $2,0001.

Checking account rates:

Many bank checking accounts offer similar interest-building opportunities (called Annual Percentage Yield, or APY) as with savings accounts. According to the FDIC’s weekly national rates as of May 24, 2019, the average rate is 0.06%, with variations across banks. If you know you’ll meet the bank account requirements (generally speaking, a certain dollar amount in deposits and average monthly balance), comparing these rates can help you earn a bit more on your cash over time.

Overdraft fees:

Today, many banks offer protection or purchase cushions to help alleviate overdraft fees (and the “sorry, card declined” embarrassment). Still, bank account overdraft fees can really stack up, though some banks may offer lower fees or fee forgiveness.

Monthly service fees:

According to a 2018 Bankrate fee study, the national average for bank monthly service fees in 2019 is $5.57, the lowest it’s been since 2014. And, the monthly balance requirements to avoid paying fees altogether are the lowest they’ve been since 2014, too— an average of $631.31.

Out-of-Network ATM fees:

At some point you’ll likely find yourself in need of cash, with no branded ATMs in sight. Here’s where understanding ATM fees is important. You’ll be charged a fee by your non-member ATM, but your bank may also charge a fee. According to a 2018 Bankrate fee study, the average total cost of withdrawing cash from an out-of-network ATM nationwide is $4.68.

Compare Bank Account Perks

What often makes a bank account special — and turns customers into die-hards — are the bonus perks you get with your card. From cash back rewards to special offers and fun card upgrades, you get to decide what perks matter most to you.

Cash Back:

Did you know that some checking accounts offer cash back opportunities? It’s not just credit cards that get to have all the fun. You could earn a percentage back on some purchases, which would be returned to you on a certain schedule (usually every month or every quarter).

Earn Interest:

Earning interest on your account balance seems like another perk reserved for savings account. That’s changing! Today, some other accounts - including demand deposit accounts and checking accounts - give you the opportunity to earn interest on the balance of your account. gives you the opportunity to earn interest on your balance.2

Sign-Up Bonuses:

Sometimes, switching to a new bank account can have its perks. Some banks run special offers with incentives to sign up. These may come in the form of sign-up bonuses factors.

Exclusive Offers and Discounts:

Some bank accounts partner with retailers to offer special discounts or offers. This could include a percentage off your purchase, cash back, or other deals.

Card Upgrades:

Want more customization with the card you swipe? Look for bank cards and prepaid cards with card upgrade features. You could get an exclusive card design, personalization, or other cool upgrades. Be sure to ask your provider what’s available.