June is known as homeownership month, and we want to discuss the pros and cons of owning a home. This article will cover the most prominent benefits and drawbacks of renting versus owning a home. We encourage that you review as many as possible before deciding.

For many people, buying a home is the most significant financial decision they will make. As with any major decision, a pivotal question is: why?

There is no right or wrong answer, as each person’s response will vary depending on their life circumstances and financial goals. You may be looking for a bigger space to start growing a family or get into a better school system, or you may be purchasing a home as a financial asset. No matter your reasoning, it’s important to note that the benefits of homeownership don’t come without cost and limitations, so it is essential to weigh the pros and cons of buying a home and think through the process before a decision is made.

One recent significant consideration: Unlike in 2021, experts believe Americans will have a better chance at finding a home in 2022 but will face a competitive seller’s market as first-time home buyers will outweigh the inventory recovery. Additionally, housing prices are expected to increase by 6.2%. While this is great for sellers, it’s not so great for those who may not be able to afford a down payment or who can’t act as fast. In this new housing market, there is no reward for hesitating.

Don’t let what’s happening in the housing market decide for you. Whether you are a first-time homebuyer or a seasoned veteran, what matters when purchasing is your personal finances and if the pros outweigh the cons for your situation.

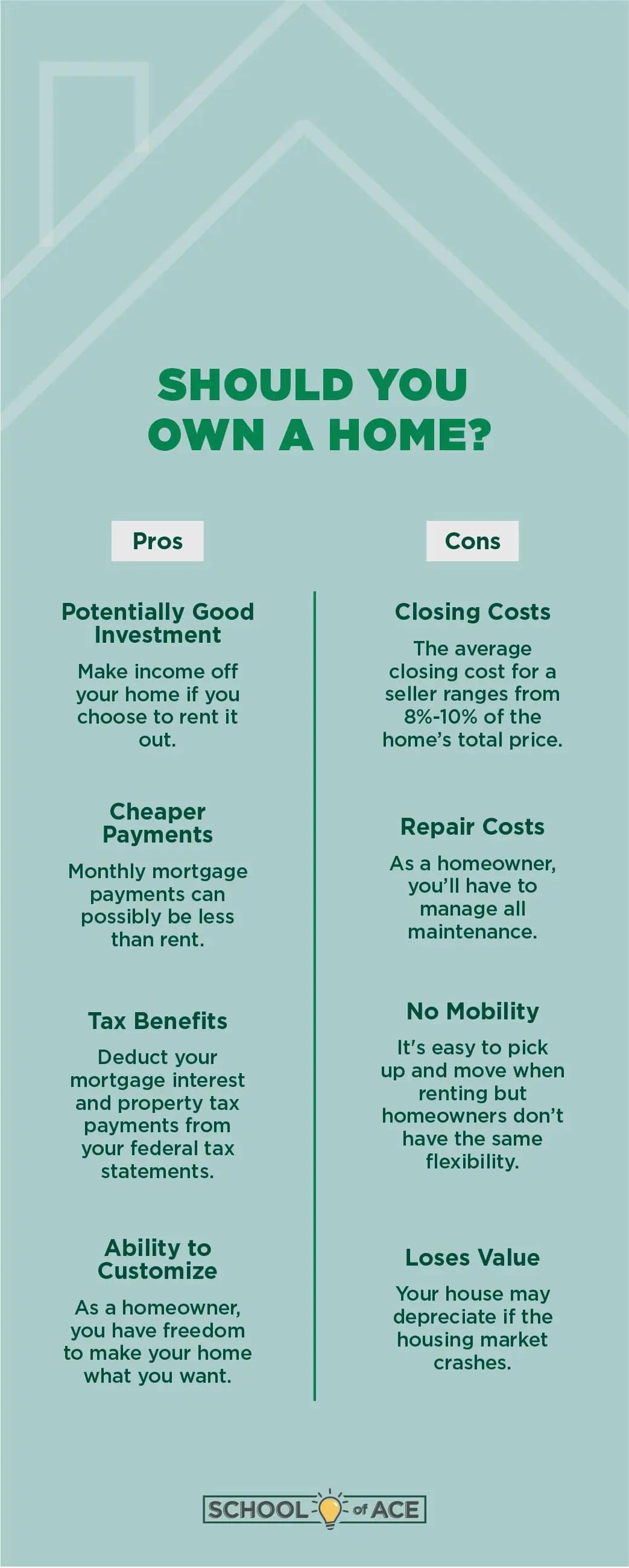

Advantages and Disadvantages of Owning a Home

##

What are the Advantages of Owning a home?

- A potentially good long-term investment: Because you own the physical asset of a home, you can potentially make a profit on it, either down the road when you resell it or by renting it out.

- Building Equity: Equity refers to the amount of value you have in an asset. As you pay off your mortgage each month, you will be adding equity to your home buy paying down the principal. This is different from paying rent because you are adding value to an asset you own rather than adding value to a landlord’s investment.

- Lower Payments: With a fixed-rate mortgage, your monthly mortgage payment can potentially be a lot less than a rental payment if you own a home. In addition, your payments on principal and interest will stay the same until the mortgage is paid off. Note that you’ll have to factor in external costs like property taxes, homeowners’ insurance, interest, maintenance, and more.

- Federal Tax benefits: There are tax benefits of owning a home that renters do not receive. Homeowners may be able to deduct their mortgage interest and property tax payments from their federal income taxes.

- Ability to customize: When you live in a rental, you may not be able to make any drastic improvements to your living space. But as a homeowner, you have the freedom to make as many changes as you want to your home.

What Are the Disadvantages of Owning a home?

- COVID-19 costs: With the housing market frenzy caused by the pandemic, sellers are typically getting more than the asking price and are getting it relatively quick. This makes it much harder for a first-time homebuyer who can’t compete with other high bidders or hasn’t saved the needed down payment.

- High upfront costs: Closing costs on a mortgage can run from 8% to 10% of the purchase price, costing you thousands. You will also have to factor in mortgage insurance and home inspection costs.

- Maintenancecosts: You’ll oversee all maintenance costs when you own a home. This includes replacing the roof, maintaining the air conditioning, or other emergency repairs. However, if you have a home warranty, some of these costs may be covered.

- No mobility: When renting, it’s easy to pick up and leave once your lease is up. As a homeowner, you won’t have that same flexibility.

- Market Volatility: If the housing market stays strong, you can potentially make a profit if you decide to sell your home sometime in the future. However, your house may depreciate if the housing market crashes.

- Qualifying: Qualifying for a mortgage can be complicated. Lenders will review your credit score, debt-to-income ratio, and other factors to determine if you are worth the risk.

###

The Bottom Line

The most significant drawbacks to owning a home mostly come down to costs, including closing costs and homeownership fees. So, if you are a first-time homebuyer and are considering purchasing your first home, taking the time to consider the effects it will have on your personal finances will make the difference. We also encourage that you do intensive research on mortgage lenders, as promising to repay a loan is a big commitment. On the other hand, owning a home can be an excellent potential investment if the housing market stays healthy.