Just as your body’s vital signs reflect the state of your physical health, your credit score is an important indicator of your overall financial health. When you go to a clinic for a checkup, the first thing a nurse will do is check your vital signs – temperature, heart rate (pulse), respiratory rate, and blood pressure – before moving on to other questions or tests. Your financial health is likewise evaluated when you decide to finance a large purchase, like a car or home, or rent an apartment, or purchase insurance.

The “vital signs” a lender, property manager, or insurance provider are checking and measuring for in these scenarios are pulled from your credit report. They use this information to assess whether or not to do business with you. It pays (pun intended) to know what’s in your credit report and how that information impacts your credit score.

What’s in my credit report?

Your credit report contains personal information, credit account history, credit inquiries, collections information, and public records information. It’s a good idea to get a free copy of your credit report annually from each of the three major credit bureaus, Equifax, Experian and TransUnion, so you can check for any inaccuracies and dispute any errors. Credit fraud and identity theft are also common, and having regular access to reports from all three credit bureaus is important to nip any suspicious activity in the bud as early as possible.

Let’s focus on credit account history, though, because this is the most detailed area of your credit report. The credit account history section lists each account as it is reported to the credit bureaus by your lenders. The exact information and order of the report varies by credit bureau but generally includes the name of the lender, account number, date the account was opened, type of loan, credit limit or original loan amount, and status of the account – open/current, closed, paid, late (30-60-90 etc. days).

Your payment history – what’s reported in the account status line - is the most important component of your FICO® Score. This score is an important factor used by lenders to determine how likely you are to repay a loan or credit card.

What is a FICO Score?

A FICO Score, created by Fair, Isaac and Company, is a three-digit number ranging from 300-850 that estimates your credit worthiness by comparing your credit information to the patterns in hundreds of thousands of past credit reports. FICO Scores are based solely on the information in consumer credit reports maintained by the three major credit bureaus.

Each credit bureau calculates your score based on their data, so FICO Scores across the three reports may be slightly different. In fact, this is common. Among the reasons this may occur are:

- Some lenders don’t report to all three credit bureaus.

- Some lenders may report credit information to different bureaus at different times of the month, causing a lag in data accuracy.

- You didn’t pull them all at the same time, and there can be changes from one month to the next.

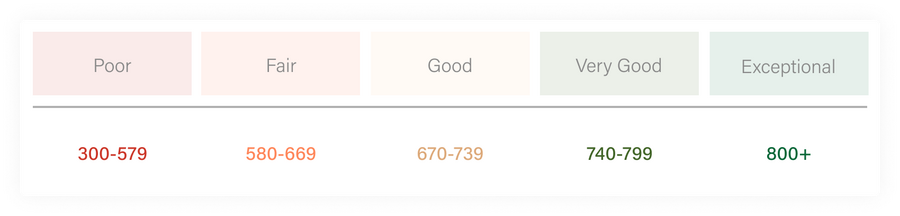

You might be wondering how your FICO Scores stack up against the average scores of U.S. consumers. What is a good credit score? Each segment along the 300-850 entire range has a rating. FICO lists those ratings as follows:

- 300-579: Poor – well below average

- 580-669: Fair – below average

- 670-739: Good – slightly above average

- 740-799: Very Good – above average

- 800-850: Exceptional – well above average

How is my FICO Score calculated?

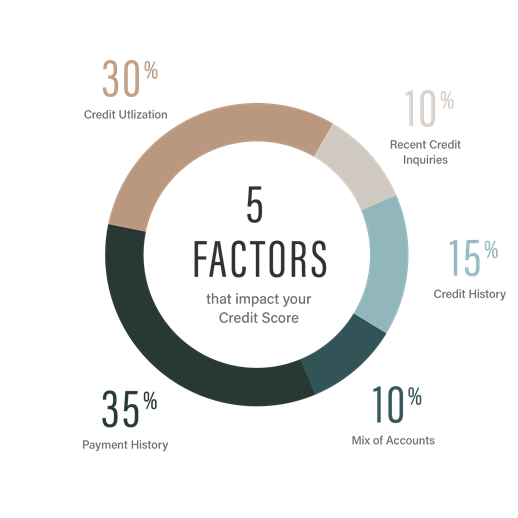

Depending on how your FICO Score stacks up, you might be wondering how to improve it to the next rating or higher. The biggest factor that you can control is paying your accounts on time consistently. Payment history is 35% of your FICO Score. The other four factors by percentage are: amounts owed vs. how much credit you have access to (i.e., your credit utilization) (30%), length of credit history (15%), recent credit inquiries (10%), and credit mix (10%). Check out this FICO video, “What Goes into FICO Scores?”, for more information.

A CNBC article, “What Happens When You Miss a Credit Card Payment,” describes how missed or late credit card payments affect your FICO Score: “A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score will drop.” Additionally, the article warns that “the higher your credit score, the greater negative effect a 30- or 90-day missed credit card payment has on your account. That’s because someone with a lower credit score already has their past behavior reflected in their score.”

But how many points are we talking about here? According to Advantage Credit Counseling Service, just one late payment added to your credit report can cause your FICO Score to drop 50-120 points!

How do I improve my payment history?

It could take months to see results, but you can improve your payment history in two key ways: pay all credit accounts on time and dispute lender reporting mistakes to the credit bureaus (e.g., you can prove you made a payment, but it is reported as delinquent). As for paying on time, use technology to your advantage and sign up for autopay or payment due alerts on your accounts wherever possible. If you can’t pay the entire minimum amount due, communicate with the creditor or lender and discuss your options. While that’s not a fun conversation to have, lenders view lack of communication as irresponsible.

Federal law allows you to dispute inaccuracies on your credit reports for free. Both the Federal Trade Commission and the Consumer Financial Protection Bureau recommend that you contact both the business reporting the information incorrectly and the credit reporting company listing the error. TransUnion, Equifax, and Experian all have places on their websites for you to dispute reporting errors, making it easy to file directly with them.

If you haven’t paid accounts on time in the past, you can choose a different path moving forward. You might even consider starting fresh with a new credit account as your budget allows. This may be useful if you have a long credit history and haven’t applied for a new account lately. The right credit card could also be a way to establish a solid payment history if you haven’t had a credit account before.

How do lenders use my FICO Score?

Lenders typically do a credit check when you apply for a credit card or a loan, because they are assessing your approval risk. Ninety percent of top U.S. lenders use FICO Scores as part of this process. If a lender decides to approve you, your credit score also affects the terms and interest rates for which you may qualify.

Did you know that there are different versions of base FICO Scores and that these differ from industry-specific FICO Scores? While FICO 8 is the most widely used, there’s also a FICO 9 and FICO 10. Lenders adopt updated versions at different rates, just like companies do with new software releases. Industry-specific FICO Scores include FICO® Auto Scores and FICO® Bankcard Scores for car loans and credit cards, respectively. Which FICO Score you should pay attention to depends on what you’re applying for.

How did you do?

Remember that information is power. Understanding what’s in your credit report and how it impacts your credit score sets reasonable expectations about your creditworthiness and how you might improve your odds of lender approval. By regularly monitoring the progress of your credit profile, you know where you stand and how to receive a better credit health scorecard on your next check-up.

This blog is not intended to provide any tax, legal, financial planning, insurance, accounting, investment, or any other kind of professional advice or services. To make sure that any information or suggestions in this blog fit your particular circumstances, you should consult with an appropriate tax or legal professional before acting on any suggestions or information that we provide.