As a parent, you want to best for your child’s future. Sending your kid off to college is one of the milestones of parenting, something you probably look forward to. Getting accepted to college is all about the hard work and commitment of your child. Paying for college, on the other hand, could become a responsibility for your finances.

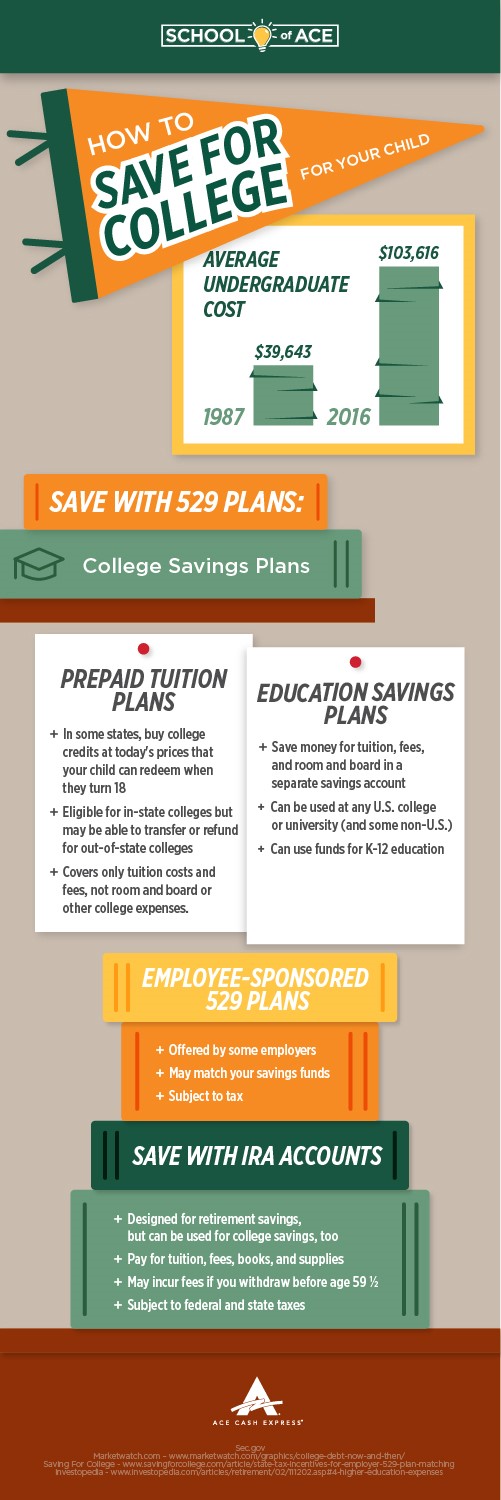

It’s no secret that college costs are rising. In 2017, a MarketWatch report noted that costs for an undergraduate degree have exploded more than 161% since 1987:A

1987 undergraduate cost, national average: $39,643

2016 undergraduate cost, national average: $103,616

Government assistance in the form of Pell Grants and institution-based grants can help. Work-study pay can help as well. But if you want to help your child avoid the high costs of college tuition, your financial assistance can help, too.

When to Start Saving for College

The best time to start saving is before your child is born. The second best time to begin is now. As with any savings journey, the earlier you begin, the more funds you can accumulate toward your goal.

It can be challenging for parents to save consistently without a plan. That’s why college savings plans are so helpful.

How to Save Money for College with a 529 Plan

There are specially-designed savings accounts for educational savings. A 529 plan is “a tax-advantaged savings plan designed to encourage saving for future education costs.” These plans are sponsored by states, state agencies, or educational institutions.B

529 plans are created specifically for paying tuition, and fall into one of 2 groups:

Prepaid Tuition Plans:

Prepaid tuition plans are helpful when you know that your child will attend a specific, in-state college, although you may be able to transfer the value to a private or out-of-state college. Just note that you may lose some of the value, depending on the state.

With a prepaid tuition plan, you can save money for college by buying credits at participating in-state, public colleges and universities. With this 529 plan, you could purchase, for instance, your child’s suite of non-major related “basic courses” at today’s price, and your child can then redeem them when they enroll.B

Individual states sponsor the funds paid into a prepaid tuition plan. This means that the accounts are managed by the state you choose, and the federal government does not guarantee the funds. So, if the state runs into financial trouble before your child gets a chance to redeem the credits, you may or may not get your money back. Some states offer a money guarantee, but others don’t. This type of 529 plan does not cover room and board fees, only tuition costs.

Education Savings Plans:

Education savings plans allow you to save money for your child’s tuition, mandatory fees, and room and board at any U.S. college or university (sometimes, at non-U.S. institutions, too). If you prefer, you can also choose to use the funds you save to pay for tuition at an elementary school or secondary school, up to $10,000 per year. This is helpful if you’re considering private school or religious education for your child before college.

As with prepaid tuition plans, education savings plans are state-sponsored. However, you won’t run into issues with state residency or in-state college requirements. Your child can choose to attend any public or private university and have coverage for courses, mandatory fees, and room and board.B

Employer-Sponsored 529 Plans:

Some employers offer 529 plans through their company for employees. In some cases, the employer may match your contribution. However, in most cases, those matches are taxed as income and are subject to tax. If your employer is based in a state other than the one you live in, you could also miss out on in-state tax savings.

Reach out to your job’s HR department to find out if your employer offers a 529 savings plan, and to learn more about how to contribute.C

Other Ways to Save Money for College

There are other ways to prepare for your child’s future college career without a 529 plan. You can choose to save on your own by opening a dedicated savings account or you can invest in an Individual Retirement Account (IRA).

Open a Bank Account with a High-Yield Savings Account

Choose a bank account with a high-yield savings account to grow your college savings over time. With this account, you can put money into savings and earn more in interest than with a traditional savings account. With the ACE Flare™ Account by MetaBank®1 Optional Savings Account, you can earn up to 6.00% Annual Percentage Yield (APY) with qualifying Direct Deposit activity2.

Open an IRA

Individual Retirement Accounts (IRAs) are designed for retirement savings, but Investopedia suggests they could be helpful for your child’s college savings as well.D

You can pay for expenses, including tuition, mandatory fees, books, and supplies with IRA funds. However, because IRA accounts are primarily created for retirement savings, you can incur some penalties in the form of fees if you withdraw before age 59 ½. Your withdrawals may also be subject to federal and state taxes.E

To help avoid penalties, choose a Roth IRA account for college savings. With a Roth IRA, you can withdraw up to the amount you contributed before earnings (interest) and avoid penalties when the account has been open for at least five years. Even if you’re younger than 59 ½, your withdrawals are tax-free when they are used for qualifying educational expenses like tuition, room and board, mandatory fees, and books.E

Building Good Habits to Save for College

Now that you’re armed with more knowledge on college savings, you can start putting money away. But the question remains: how can you find space in your budget to do so?

Your financial situation may vary based on your monthly income, your living situation, any health concerns you have, and more. Because every situation is different, there’s no one-size-fits-all savings plan.

However, there are small ways to start saving even when money is tight.

Examine your regular finances. Where can you cut costs? Even $25-$50 each pay period can add up over time toward covering education costs.

Try couponing. Thanks to the internet, it’s easier than ever to snag deals on everyday purchases.

Get your child involved. If you have a teen, get him or her involved in saving for their college fund. Summer jobs and side gigs are another great way to teach money management skills (and to learn the value of saving).

Saving for college early can help cut costs for you and your child later down the road. Let us know in the comments section how you’re preparing for the future!