How to Read Your Paycheck stub: Understand Taxes, Deductions, and More

Getting paid should be simple, right? If you earn a certain amount per hour, you might expect to see that exact amount reflected in your paycheck stub, but many people are surprised to find that once they receive their paycheck a significant portion has been taken out in the form of taxes, deductions, and more. Here’s what you need to know about taxes and deductions in order to understand your paycheck stub.

How to Understand Your Paycheck

Gross Pay vs. Net Pay

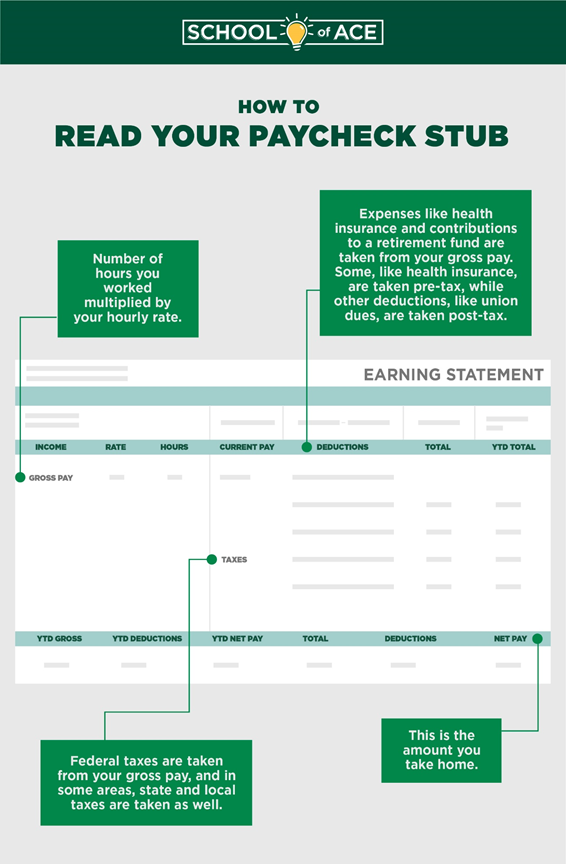

Understanding your paycheck begins with knowing the difference between gross pay and net pay. Your gross pay is computed by multiplying the number of hours you worked times your hourly rate. For example, if you earn $15 an hour and you worked 40 hours in a week, your gross pay would be $600. Your net pay, however, is your gross pay minus any taxes and deductions. Net pay is the amount you take home. So, if your gross pay is $600 and you have $100 worth of taxes and deductions, your net pay will be $500.[1]

Gross pay = (# of hours worked) X (hourly rate)

Ex. (40 hours) x ($15 per hour) = $600 gross pay

Net pay = (Gross pay) – (taxes and deductions)

Ex. ($600) – ($100) = $500 net pay

How Much Taxes Are Taken out of a Paycheck?

Understanding your paycheck also requires you to know what kind of taxes are being withheld. There are federal taxes taken from your pay, and in some areas, state and local taxes on personal income as well.

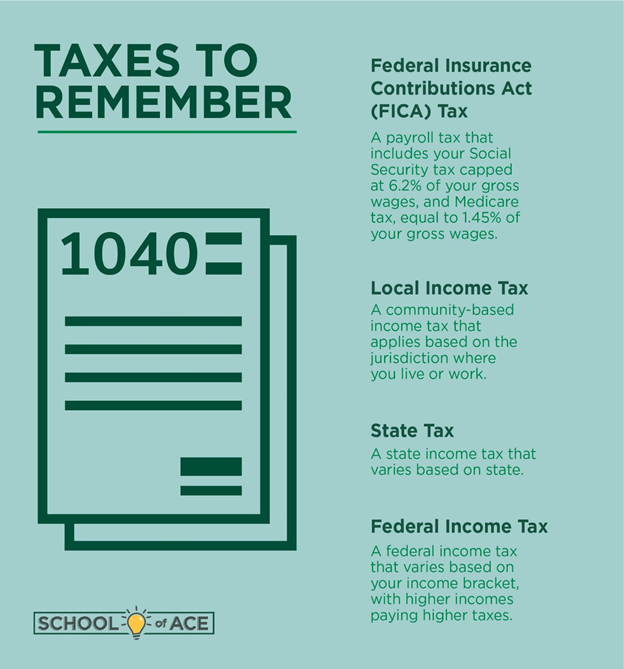

The first federal tax is the Federal Insurance Contributions Act (FICA) Tax (also called payroll tax), which includes Social Security tax and Medicare tax. Social Security tax amounts to 6.2% of the first $142,800 your gross wages in 2021 and Medicare tax amounts to 1.45% of your gross wages.2 Social Security tax is intended to provide benefits to Americans after they retire beginning as early as age 62.[2] Medicare tax is the federal health insurance program for people who are 65 or older or have certain disabilities.[3]

Your paycheck will also have the Federal Withholding Tax (federal income tax) withheld. The amount of this tax is based on the information you provided on your Form W-4 as well as your taxable income amount.5 The more gross income you earn during a pay period, the higher your Federal Withholding Tax should be. If you’re an hourly worker, this can help explain why the more hours you work, the more taxes are taken from your paycheck.

Depending on your state, you may also have State Tax withheld. This varies from state to state, ranging anywhere from a fixed tax to a graduated tax based on your income. Some states have no income tax at all. The best way to determine your State and Federal Taxes is to use a Paycheck Estimator.

Finally, some areas may withhold Local Tax on your paycheck. If this tax applies in the city where you work, you may see this tax withheld as well.6

Financial Literacy Dictionary: What are income taxes?

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction, according to Investopedia.7

Taxes to Remember:

Federal Insurance Contributions Act (FICA) Tax: a federal income tax that includes your Social Security tax, equal to 6.2% of your gross wages, and Medicare tax, equal to 1.45% of your gross wages.8

Federal Withholding Tax: a federal income tax that varies based on your income bracket, with higher incomes paying higher taxes.

State Tax: a state income tax that varies based on state.

Local Tax: a community-based income tax that varies based on the jurisdiction where you live or work.

What Are Deductions?

Taxes aren’t the only deductions taken out of your paycheck. You may also have other deductions taken out for things like health insurance, dental insurance, contributions to a retirement fund, disability insurance, disability insurance, union dues, donations to charity and garnishments. Some are deducted pre-tax, like health insurance, and some are deducted post-tax, like donations to charity and union dues.

When it comes to contributing to a retirement fund, the deduction may be either a pre-tax deduction or a post-tax deduction. A traditional 401k has the advantage that your contribution is taken out before taxes. This lowers your taxable income, and therefore, your income taxes for the year, although you will have to pay tax on the money when you withdraw it during retirement. With a Roth 401k, on the other hand, contributions are made post-tax so it won’t lower your taxable income like contributions to a traditional 401k, but you withdraw funds from a Roth 401k tax-free.10

Understanding the ins and outs of gross to net pay, income taxes, and other deductions can be tough. If you have a fluctuating income or work odd hours, it can be even more challenging. However, understanding the basics can be a helpful step toward becoming more financially literate.

Sources:

- https://support.gusto.com/account-setup-maintenance/manage-your-business/payroll-pointers/1066219731/What-s-the-difference-between-net-pay-and-gross-pay.htm#:~:text=For%20example%2C%20when%20you%20tell,in%20their%20pocket%20on%20payday.

- https://www.surepayroll.com/resources/blog/how-much-federal-tax-is-taken-out-of-my-paycheck

- https://www.investopedia.com/terms/s/socialsecurity.asp

- https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/whats-medicare

- https://www.hrblock.com/tax-center/filing/personal-tax-planning/paycheck-taxes/

- https://www.hrblock.com/tax-center/filing/personal-tax-planning/paycheck-taxes/#:~:text=Each%20employer%20withholds%206.2%25%20of,come%20out%20of%20your%20pay.

- https://www.investopedia.com/terms/i/incometax.asp

- https://www.ssa.gov/thirdparty/materials/pdfs/educators/What-is-FICA-Infographic-EN-05-10297.pdf

- https://www.adp.com/resources/articles-and-insights/articles/p/payroll-deductions.aspx#:~:text=Post%2Dtax%20deductions%20are%20taken,required%20taxes%20have%20been%20withheld.

- https://www.investopedia.com/terms/1/401kplan.asp