Studies show that one of the top New Year’s resolutions is to “save money”1,2. They also show that most resolutions fail by February3. What gives?

Resolutions tend to be broad and vague. Setting out to “save money” is a great start, but that alone doesn’t give you the tools you need to make it happen. That’s why we suggest focusing on setting specific goals.

Choose the Right Financial Goals

You may have many big things you want to accomplish in the coming year, like going on a family vacation, paying off debt, or starting a business. You may instead want to focus on smaller habits like sticking to a household budget, managing your spending, or spending less on eating out.

How do you decide which to focus on, and how can you make them stick long past February? Start by making a list of all the financial goals you could pursue in the year and pick one or two to focus on.

Goals may be long-term or short-term. If your goal requires many steps or a longer time to execute, you can consider it to be a long-term goal. Short-term goals, on the other hand, often have shorter time spans to execute and less steps.

Examples of long-term financial goals:

- Pay off all credit card debt

- Save for your child’s education

- Start a business

- Pay off your car

- Save money toward a down payment for a home

Examples of short-term financial goals:

- Create a monthly budget

- Build an emergency fund

- Save for a vacation

- Implement a “no spend” month

- Save 10% of your income each month

- Catch up on late credit card payments

- Lower your monthly bills

You may choose to break down one long-term goal into monthly or quarterly steps. Or, you may choose to tackle one or two short-term goals throughout the year.

Think about what’s most important to you and your family. Do you value quality time together? Planning a family vacation could be a great goal. Have trouble controlling your extra spending? Challenge yourself to a “no spend” month twice a year and create a monthly budget.

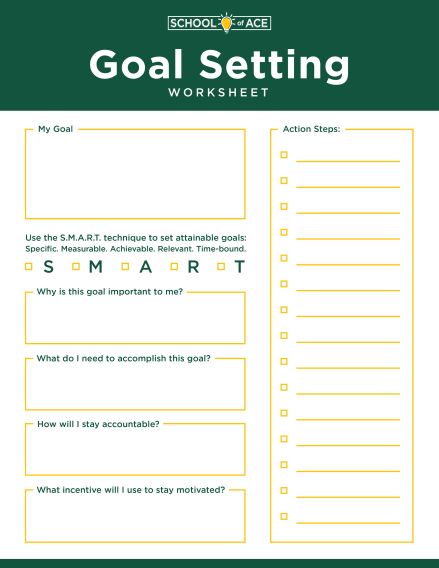

Make Your Goals S.M.A.R.T.

Now that you have a better idea of what you want to accomplish, set your plans in motion with the S.M.A.R.T. technique. This technique is a great way to take goals from vague to concrete. When you know exactly what you need to do and when, you’ll be more likely to follow through to the end.

Specific. Think like a journalist and ask: who, what, when, where, and why will I achieve this goal?

I will save money to buy a home so that I can leave a future legacy for my children and benefit from the investment in property.

Measurable. Determine how will you identify your success and know that you’ve accomplished the goal.

I will save 10% of my income for an emergency fund so I can pay my bills for three months if I fall on hard times.

Achievable. Examine how realistic the goal is for your lifestyle and abilities.

I will cut my extra spending by $50 each month.

Relevant. Is this the right goal at the right time? Consider your current circumstances to determine if this is the best goal for you.

I will save $1,000 for a family vacation before my daughter goes to college in August.

Time-bound. When will you achieve this goal? Do you have just one deadline, or are there smaller milestones to reach along the way?

I will save $100 every month to hit my target of $1,200 in savings by December 31.

Find Ways to Stay Accountable

Setting goals is great, but consistently working towards achieving them is what counts. Now that you’ve set S.M.A.R.T. goals, keep yourself accountable as the year progresses using a few techniques.

Write Down Your Goals. Research suggests you could be up to 1.4 times more likely to achieve your goals when you write them down.4 We’ve created a Goal Setting Worksheet to help! Write down your top goals and the action items you need to take to achieve them. Then, post it somewhere you’ll see it daily to help you stay focused.

Find an Accountability Buddy. Ask a trusted friend or partner to keep you accountable. It can be as simple as sending a weekly text with a progress update. Offer to be their buddy, too! You can share your challenges and wins as the year goes on and keep each other motivated.

Give Yourself an Incentive. Think of this like the carrot on the end of the stick. What will entice you to stay motivated? Maybe you can treat yourself to a movie night after a “no spend” challenge is complete or throw yourself a little celebration when you hit your goal.

Track Your Progress. Ever tried to recount what you ate for dinner one night two weeks ago? It can be just as challenging to remember the little wins and setbacks you experience on your journey to goal achievement. Try using a journal or habit tracker to keep up with your progress. Write down when you chose to eat in instead of ordering out or when you put an unexpected bonus into savings instead of spending it. Looking back at your progress is a great motivator for future success!

Set and reach your financial goals this year or anytime! By setting S.M.A.R.T goals and staying accountable, you’re more likely to follow through when it counts.