What Is Identity Theft and How Can You Report It?

Identity theft is a pervasive problem in the United States, with 14.4 million Americans falling victim to identity theft in 2019 alone.[1] A staggering 33% of U.S. adults have experienced identity theft,[2] which makes it all the more important to know what the warning signs are, how to report it, and how to prevent it. In this blog post, you’ll learn some tips you need to know about identity theft to help you keep your personal information safe.

What Is Identity Theft?

Identity theft occurs when someone steals your personal information and uses it to commit fraud. Identity thieves may use your information to falsely file tax returns, get medical services, or apply for credit, among other things.[3]

Tax ID theft is a common form of identity theft in which someone uses your Social Security number to falsely file federal or state tax returns, usually in an attempt to fraudulently receive a refund.[4] Medical ID theft occurs when someone steals either your Medicare ID or your health insurance member number in order to receive medical services or send fraudulent bills to your insurer.[5] With credit ID theft, someone may use your Social Security number to open new lines of credit and rack up debt in your name.

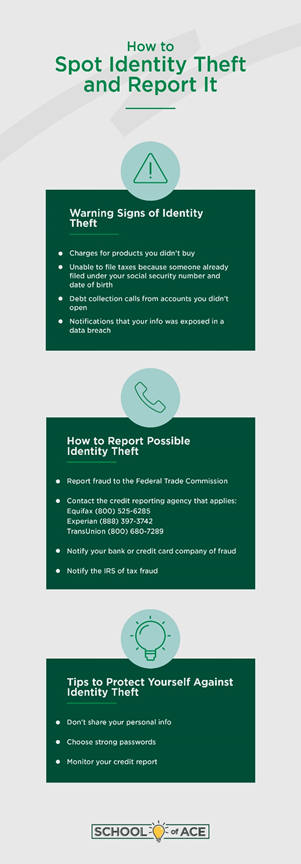

Warning signs that you could be the victim of identity theft include:[6]

- Seeing charges for products or services you didn’t buy;

- Being unable to file taxes because someone has already filed using your Social Security number and date of birth

- Receiving debt collection calls for an account you didn’t open; and

- Receiving a notification that your information was exposed in a data breach.

#

How Can You Report It?

If you see any fraudulent charges on your bank statement or witness any of the above warning signs, there are several steps you can take to report the possible identity theft, depending on your situation.

General Identity Theft

- Report fraud to the Federal Trade Commission

- Online at IdentityTheft.gov

- Contact the applicable credit reporting agencies:

- Equifax: (800) 525-6285

- Experian: (888) 397-3742

- TransUnion (800) 680-7289

Bank Fraud

- Notify your bank or credit card companies

Tax Fraud

- Call the IRS

If you report identity theft to the FTC online, they’ll provide you with an identity theft report and a recovery plan. This will allow you to use an online account to update your recovery plan and track the progress of your report. It will also provide you with prefilled form letters for you to send to your creditors.[7]

It can be helpful to report identity theft to the police, if you believe you know the thief, they used your name in an encounter with the police, or if your creditor requires you to file a police report.[8]

If you’ve been the victim of a specific type of identity theft such as Medical ID theft or Tax ID theft, you can report it to the specific federal agencies involved. If you have Medicare and are the victim of Medical ID theft, contact Medicare’s fraud office. If you’re the victim of Tax ID theft, report it to the IRS.

Tips to Protect Against Identity Theft

The American Bankers Association has released several important tips to help Americans avoid falling victim to identity theft.[9] Here are a few ways to protect yourself:

- Don’t share your personal information such as your Social Security number or account information on social networking sites.

- Don’t give your personal information to anyone who contacts you unsolicited over the phone, by text, or online.

- Choose strong, unique passwords for all your online accounts.

- Keep your PINs and passwords safe and change your passwords regularly.

- Shred all papers that have sensitive information on them, such as receipts, bank statements, and credit card offers.

- Enroll in online banking and possibly e-bills to reduce the risk of your mail being stolen.

- Monitor your credit report and bank statement regularly.

- Keep your computer and mobile device up to date and protected from malware.

By keeping your personal information safe and monitoring your credit and personal information online, you can reduce the risk of falling victim to identity theft.

[1] https://www.iii.org/fact-statistic/facts-statistics-identity-theft-and-cybercrime

[2] https://www.proofpoint.com/us/newsroom/press-releases/global-cybersecurity-awareness-survey-reveals-33-percent-us-respondents-have

[3] https://www.usa.gov/identity-theft

[4] https://www.irs.gov/newsroom/taxpayer-guide-to-identity-theft

[5] https://oig.hhs.gov/fraud/medical-id-theft/index.asp

[6] https://us.norton.com/internetsecurity-id-theft-5-red-flags-of-identity-theft.html

[7] https://www.ftc.gov/faq/consumer-protection/report-identity-theft

[8] https://www.lifelock.com/learn-identity-theft-resources-how-to-report-identity-theft-to-police.html

[9] https://www.aba.com/advocacy/community-programs/consumer-resources/protect-your-money/protecting-your-identity