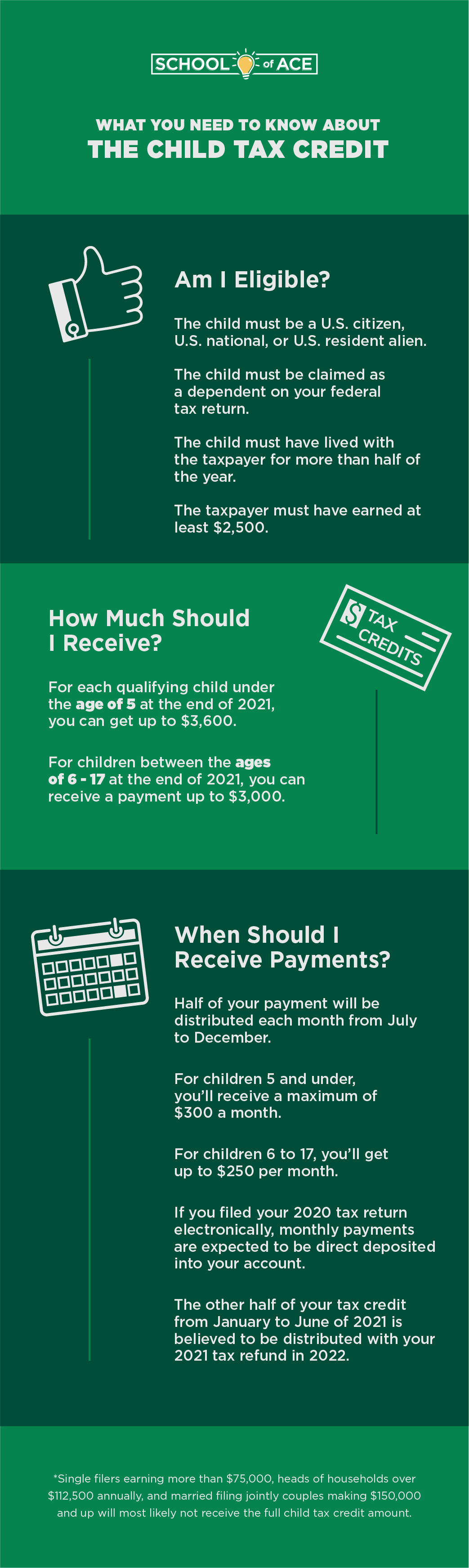

What You Need to Know About the Child Tax Credit

According to the IRS, as part of the American Rescue Plan Act of 2021, the Child Tax Credit will start advance payments through July and end on December 31, 2021 for taxpayers who have qualifying dependents.1 This year, you can claim up to $3,600 for each qualifying child, which is an increase that only applies to the 2021 tax year, as long as your income and your child’s age meets the proper qualifications.1

In this article, we’ll cover what you need to know about the child tax credit, including eligibility requirements for the child tax credit and how much you can receive for each qualifying dependent.

Am I Eligible to Receive the Child Tax Credit?

If you can claim at least one child dependent under the age of 17 on your tax return, you possibly could be eligible for the Child Tax Credit. The following are some eligibility requirements for the child tax credit:

- The child must be a U.S. citizen, U.S. national, or U.S. resident alien

- The child must be claimed as a dependent on your federal tax return

- The child must have lived with the taxpayer for more than half of the year

- The taxpayer must have earned at least $2,500

To view more eligibility requirements, you use the Interactive IRS Tax Assistant tool to determine whether you qualify for the child tax credit.

How Much Should I Get for the Child Tax Credit?

For each qualifying child under the age of 5 at the end of 2021, you can get up to $3,600. For children between the ages of 6 and 17 at the end of 2021, you can receive a payment up to $3,000. Single filers earning more than $75,000, heads of households over $112,500 annually, and married filing jointly couples making $150,000 or more will most likely not receive the full child tax credit amount.

When Will I Get My Payments?

It’s important to note that you won’t receive one large payment even if you qualify for the child tax credit. Half of your payment will be distributed each month from July to December. For children 5 and under, you’ll receive a maximum of $300 a month. For children 6 to 17, you’ll get up to $250 per month. If you filed your 2020 tax return electronically, these monthly payments are expected to be direct deposited into your account. The other half of your tax credit from January to June of 2021 is believed to be distributed with your 2021 tax refund in 2022.

The IRS has stated the first monthly payment will be July 15. If you’re looking to manage your child tax credit payments, the IRS is planning to launch a child tax credit portal sometime in early July for taxpayers who want to manage their payments or for those who want one lump sum after filing their 2021 taxes.2

Sources:

- Advance Child Tax Credit Payments in 2021 | Internal Revenue Service (irs.gov)

- There’s a catch to qualify for advance child tax credit checks. Everything to know - CNET