How to Monitor Your Credit and Personal Information Online

Identity theft is a serious issue that affects millions of Americans each year, with consumers losing over $3.3 billion in fraud complaints in 2020.[1] The fact that one in five victims of identity theft have experienced it multiple times,[2] makes it even more vital to monitor your credit and personal information online regularly. By actively monitoring your activity online, you can quickly spot identity theft when it occurs and swiftly report it.

Credit Monitoring

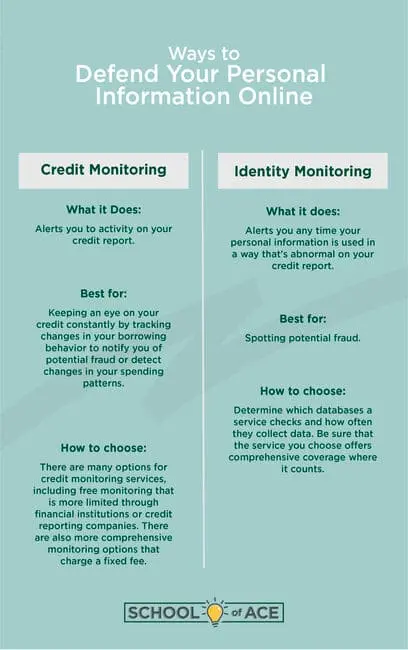

There are two types of monitoring services: credit monitoring and identity monitoring. Credit monitoring alerts you about activity on your credit report. Credit monitoring services continuously track any changes in borrowing behavior and notify you of potential fraud or changes to your creditworthiness. If your credit card is stolen and used without your knowledge, a credit monitoring service should detect the changes in your buying patterns and immediately alert you.[3]

A credit monitoring service alerts you when:[4]

- There is a hard inquiry on your credit due to a credit card or loan application being submitted in your name

- A new credit card or loan is opened in your name

- Public records show that you have filed for bankruptcy

- You receive a legal judgment against you

- Your personal information such as your legal name, mailing address, or phone number change

- Any changes to your existing account occur, such as a change in your credit score

Choosing a Credit Monitoring Service

Some financial institutions or credit reporting companies such as Experian offer limited credit monitoring services for free with an account.[5] There are also many paid credit monitoring services that provide you comprehensive coverage for a fixed price, including Privacy Guard and Experian IdentityWorks.[6] Prices and features vary from service to service, so you should look at each one to see whether they provide you with the level of monitoring you need.

Identity Monitoring

Credit monitoring only alerts you on the information that shows up on your credit report, which can leave you blind to other instances of identity theft. Identity monitoring alerts you any time your personal information is used in a way that’s abnormal on your credit report. This includes information such as your bank account information or your Social Security, driver’s license, passport, or medical ID number.[7]

An identity monitoring service alerts you when your information shows up in:[8]

- An application for a loan

- Social media posts

- A change of address request

- Any court or arrest records

- New orders for utility, cable, or wireless services

- Requests for check cashing

- Any websites used by identity thieves for trading stolen information

Choosing an Identity Monitoring Service

When searching for an identity monitoring service, you want to determine which databases the service checks and how often they check them, as well as how good they are at collecting information.[9] Data breaches can often result in personal information being stolen or illegally viewed online, which can lead to instances of identity theft. Identity monitoring services such as Credit Karma can search for breached accounts or threats to your identity on your behalf.[10]

Whether you’ve had a checking account for years or you’re just opening one, it pays to be active about monitoring your credit and identity online. After all, you don’t want to go through the process to choose the right bank account only for your account information to be stolen as a result of identity theft.

[1] https://www.iii.org/fact-statistic/facts-statistics-identity-theft-and-cybercrime

[2] https://www.idtheftcenter.org/wp-content/uploads/2018/09/ITRC_Aftermath-2018_Web_FINAL.pdf

[3] https://www.investopedia.com/terms/c/credit-monitoring-service.asp

[4] https://wallethub.com/edu/cs/credit-monitoring/25504#:~:text=Credit%20monitoring%20is%20a%20service,really%20get%20out%20of%20hand.

[5] https://www.experian.com/consumer-products/credit-monitoring.html

[6] https://www.thebalance.com/best-credit-monitoring-services-4164937

[7] https://www.consumer.ftc.gov/articles/0235-identity-theft-protection-services#monitoring

[8] https://www.consumer.ftc.gov/articles/0235-identity-theft-protection-services#monitoring

[9] https://www.consumer.ftc.gov/articles/0235-identity-theft-protection-services#monitoring

[10] https://www.creditkarma.com/id-monitoring