One of the first steps in becoming financially responsible is to create a household budget. A household budget is a tool where you estimate the amount of money that comes in and goes out each month. By setting up your household budget, sticking to it, and putting a portion of your paycheck into savings each month, you can better manage your financial future and ensure you’re covered if you run into unexpected financial situations. In this blog post, we’ll go over how to get started, how much to save, and how to stick to your household budget.

How to Start a Budget: Income vs. Expenses

The first part of your household budget to determine is your monthly income. This includes both your take-home pay from your job as well as any additional income you may earn on the side, including funds from side gigs or other income.

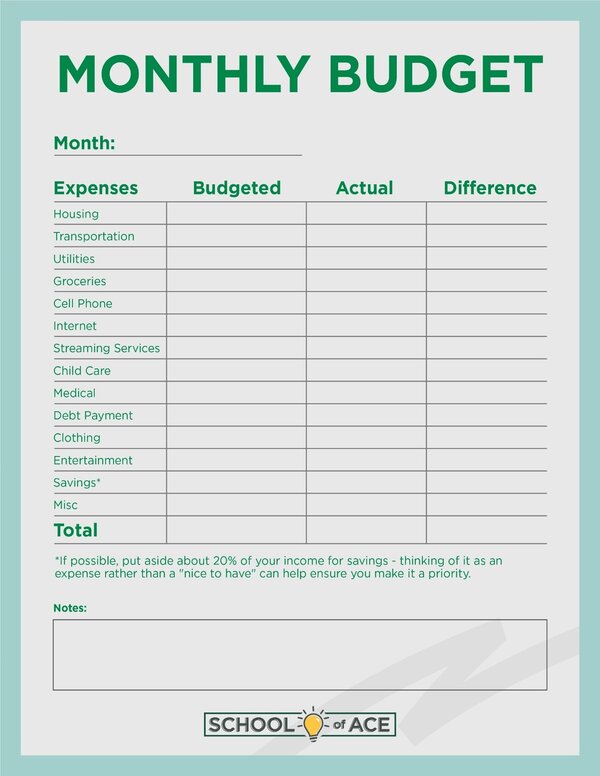

Once you have an idea of how much income you make each month, take note of all your monthly expenses. These expenses can include:

- Housing (rent or mortgage payments)

- Transportation (car payments, ridesharing, public transportation costs, gas, car insurance, car maintenance, etc.)

- Utilities (gas, water, electricity)

- Streaming services, internet, cell phone

- Groceries

- Clothes

- Childcare

- Medical (prescriptions and co-pays)

- Entertainment (dining out, movie tickets, etc.)

- Debt payments (credit card debt, student loans, etc.)

- (bank account fees, unexpected items)

- Savings (if possible, put aside about 20% of your income for savings – thinking of it as an expense rather than a “nice to have” can help ensure you make it a priority)

Once you’ve totaled up your income and your various expenses, you’ll subtract your expenses from your income to check that you’re earning more than you’re spending. If your income is higher than your expenses, you can add what’s left over each month to your savings (and save even more), use it to pay off debt faster, or use it for discretionary spending. If you don’t have enough income to cover your expenses each month, try and find ways to reduce your expenses (like entertainment or clothing) or to bring in some additional income.

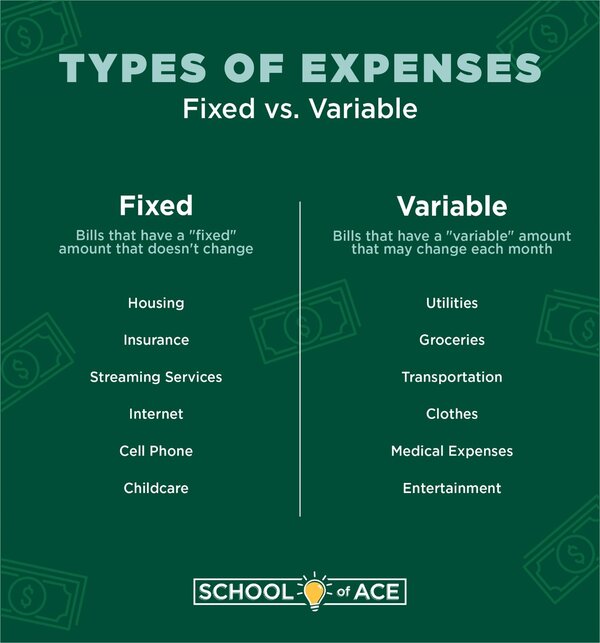

Fixed Expenses vs. Variable Expenses

Not all your expenses are going to be the same each month. You can separate your household expenses into two types of expenses: fixed expenses and variable expenses. Fixed expenses will be the same each month. These usually include things like rent, insurance, streaming services, childcare, etc. Variable expenses are recurring expenses that vary from month to month. These usually include utilities, groceries, etc.[1]

You can also add a third column for “other” expenses. This category refers to expenses that are not mandatory, but rather they are discretionary, such as birthdays, holidays, dining out, or hobbies.

Financial Literacy Dictionary: What is discretionary spending?

Experian defines discretionary spending as “quality-of-life purchases.”[2] These are nice-to-haves that, if needed, can be cut from your budget.

Budgeting on a Fluctuating Income

Budgeting on a fluctuating income can be difficult. If your income changes from month to month, the first thing you’ll want to do is determine the minimum monthly amount you will receive each month. Start by reviewing your past pay stubs to identify your lowest-income time periods. Create a budget that takes into account the peaks and valleys in monthly income. You may choose to include only fixed and mandatory variable expenses in your budget and ditch discretionary expenses from your budget altogether. For months where your income is higher, you can plan to put more money into your savings or emergency fund so that you can cover those months were your income is lower.

How Much of Each Paycheck Should I Save?

Ideally, your household budget will involve saving as much money per month as you can. A good rule of thumb is to save at least 20% of your income. This money can be set aside for things like retirement savings, short-term savings, and an emergency fund. It’s generally recommended that you establish an emergency fund to cover 3-9 months of living expenses in the event of unforeseen expenses or other emergencies.[3] If you’ve got debt to pay off, however, you might want to consider prioritizing debt payments while still setting aside a bit of savings each month even if you don’t hit the 20% target.

How to Stick to Your Household Budget

No household budget is going to work unless you have the ability to stick to it. Make sure that you’re creating a realistic household budget by taking into account the actual expenses you’ve had in the last 6 months to 1 year, no matter how small, and budget for a tiny bit of unexpected expenses. You’ll also want to take into account any upcoming expenses that may affect your budget, such as back to school supplies, holidays, or a medical co-pay for a doctor’s appointment.

Conclusion

No financial plan is complete without a basic household budget. Beyond creating a realistic budget and sticking to it, being proactive and managing your expenses can help reduce your spending and increase the amount you save each month. Remember, it takes 3-4 months to get in the rhythm of using a budget, so be patient with yourself and do your best to be consistent.

[1] https://www.business.com/articles/meaning-of-fixed-and-variable-expenses/

[2] https://www.experian.com/blogs/ask-experian/what-is-discretionary-spending/

[3] https://www.tiaa.org/public/learn/personal-finance-101/how-much-of-my-income-should-i-save-every-month#:~:text=Here’s%20a%20final%20rule%20of,30%25%20goes%20toward%20discretionary%20items.